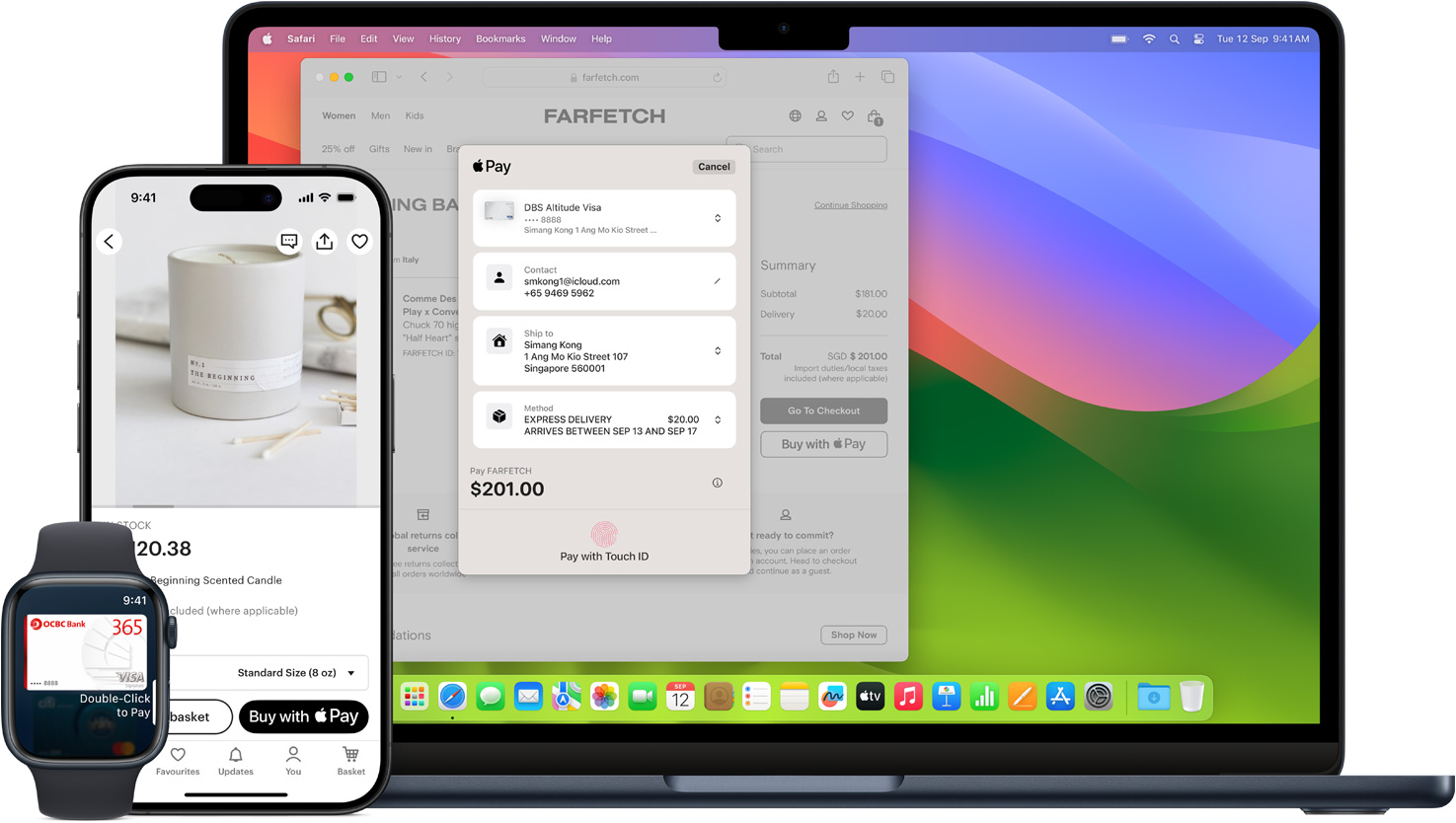

You’re standing at the checkout, phone in hand. You double-tap that side button, wait for the little "ding," and you're done. No wallet, no fumbling for coins. But in the back of your mind, there's always that nagging question: am I paying extra for this convenience? Does Apple Pay cost money?

Honestly, the short answer is no. But like everything in tech, there are some "kinda" and "sorta" moments you should know about, especially if you're sending money to friends or running a small business.

The Reality: Apple Pay Fees for You

For the vast majority of us, Apple Pay is completely free. Apple doesn't tack on a "convenience fee" for the luxury of using your phone instead of your plastic card. Whether you're grabbing a latte at a local cafe or buying sneakers on an app, the price you see is the price you pay.

Apple makes its money elsewhere. They actually charge the banks—not you—a tiny slice of the transaction (about 0.15% on credit card purchases).

If you see an extra charge on your statement, it’s almost certainly not from Apple. It’s likely a foreign transaction fee from your bank if you’re shopping abroad, or perhaps a merchant-specific surcharge that would have applied even if you swiped the physical card.

✨ Don't miss: Google Rankings and Discover: What Countries Actually See Your Content

Sending Money to Friends

This is where people get tripped up. There’s a difference between Apple Pay (paying a store) and Apple Cash (sending five bucks to your brother for pizza).

If you send money through Messages using a debit card or your existing Apple Cash balance, it’s free. Totally. But if you try to fund that "I owe you" with a credit card? That's going to cost you. Usually, there's a 3% fee for using a credit card for person-to-person payments. This isn't Apple being greedy; it's them passing on the processing fee the credit card companies charge them.

- Debit cards/Apple Cash balance: Free.

- Credit cards: 3% fee.

- Receiving money: Free.

Moving Your Money Around

So, your friend paid you back. Now that money is sitting in your digital "Apple Cash" card in your Wallet. You can keep it there and spend it at the grocery store, or you can move it to your real-life bank account.

You've got two choices here.

If you’re patient, you can do a standard ACH transfer. It takes 1 to 3 business days, and it costs exactly zero dollars.

But if you need that cash right now to pay rent or buy a last-minute flight, you can use the Instant Transfer feature. This sends the money to your debit card in about 30 minutes. The catch? As of 2026, Apple charges a 1.5% fee for this (with a minimum of $0.25 and a maximum of $15).

It’s basically a speed tax.

🔗 Read more: Black Background With Smoke: Why Your Edits Look Fake and How to Fix It

Does Apple Pay Cost Money for Businesses?

If you're a merchant, the story is slightly different but still pretty straightforward. Apple doesn't charge you a specific "Apple Pay fee."

However, you still have to pay your usual credit card processing fees. If Stripe, Square, or your bank charges you 2.6% + $0.10 for a "card-present" transaction, that’s exactly what you’ll pay when someone taps their iPhone.

For business owners, Apple Pay is treated just like a physical card. You don't need a special, expensive contract with Apple to accept it. You just need a terminal that supports NFC (Near Field Communication)—that's the "tap to pay" technology. Most modern terminals have this built-in now.

The App Store Exception

If you're a developer selling digital goods inside an app, that's where things get pricey. While not strictly "Apple Pay" in the retail sense, Apple's App Store commissions (the famous 15% to 30% cut) apply to digital purchases. Recent changes in the EU and US have opened doors for external payment links, but even then, Apple often collects a "store services" fee that can range from 12% to 27%.

✨ Don't miss: The New iPod: Why It’s Actually an Apple Watch (and What to Buy Instead)

What Most People Get Wrong

A common myth is that Apple Pay uses more data or requires a cellular connection to work in a store. Not true.

The NFC chip in your phone talks directly to the payment terminal. You could be in a basement with zero bars of service, and as long as your phone has power, Apple Pay will work. You only need data when you're adding a new card or checking your transaction history later.

Another misconception? That it’s less secure. Actually, it's the opposite. When you use Apple Pay, the merchant never even sees your real credit card number. Apple uses a "token"—a random string of numbers—to process the payment. If the store's database gets hacked a week later, your card number isn't there to be stolen.

Actionable Tips for Using Apple Pay

- Avoid Credit Cards for P2P: Always link a debit card for sending money to friends to avoid that 3% surcharge.

- Wait for the ACH: Unless it's an emergency, don't use Instant Transfer. Let the money sit for two days and save that 1.5% fee.

- Check for Rewards: Use the Apple Card (if you have it) through Apple Pay to get 2% or 3% "Daily Cash" back. It's one of the few ways to actually make money using the service.

- Watch the "Instant" Cap: Remember the maximum fee for an instant transfer is $15. If you're moving $5,000, that 1.5% would normally be $75, but Apple caps it, making it a better deal for large, urgent transfers.

Basically, if you're just buying stuff at the mall or paying for groceries, Apple Pay is a free, secure, and incredibly fast tool. Just keep an eye on those instant transfer fees and you're golden.