You’ve seen the ads. Maybe a flashy Pepe dressed like The Flash zipped across your screen, promising that Bitcoin is finally "fast." It sounds like the holy grail of crypto: the security of the OG blockchain mixed with the face-melting speed of Solana. But in an industry where "too good to be true" usually means "your money is gone," asking is bitcoin hyper legit isn't just a good idea—it’s survival.

The short answer? It’s complicated. We aren't looking at a simple "yes" or "no" because Bitcoin Hyper ($HYPER) is currently a project in the making, and there’s a massive gap between a whitepaper’s promises and a functional, secure network.

What Exactly Is Bitcoin Hyper?

Basically, it’s a Layer 2 (L2) solution. If you aren't a total nerd, think of Bitcoin as a high-security vault that takes forever to open. Bitcoin Hyper wants to build a high-speed highway right next to that vault.

It uses something called the Solana Virtual Machine (SVM). This is actually a pretty clever move. By plugging Solana’s engine into the Bitcoin ecosystem, the developers claim they can process thousands of transactions per second. They’re also using Zero-Knowledge (ZK) rollups, which is basically a way to bundle a bunch of transactions together and prove they’re valid without clogging up the main Bitcoin chain.

But here’s the kicker. The team behind it is anonymous.

Now, crypto purists will tell you that Satoshi Nakamoto was anonymous, so who cares? Honestly, that’s a weak argument in 2026. Satoshi didn't run a multi-million dollar presale with a 700% APY. When you're handing over your hard-earned BTC or USDT to a "Pepe-Flash" mascot, you're taking a leap of faith that would make an acrobat nervous.

📖 Related: Why the earth is spherical: The science that actually holds up

The Presale Hype and the "721% APY"

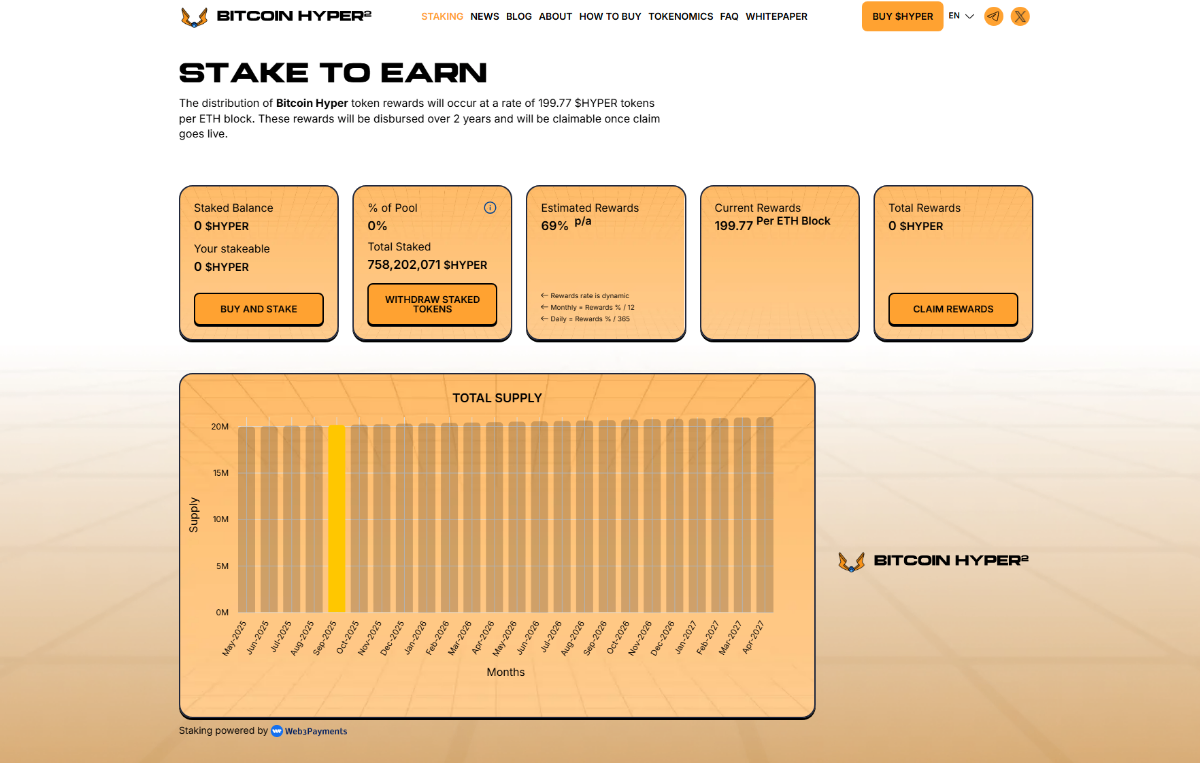

Let’s talk about the elephant in the room. During its 2025 presale, Bitcoin Hyper was dangling some insane staking rewards. We’re talking triple-digit percentages.

High APYs are a classic marketing tactic to get people into a project early. Is it a scam? Not necessarily. But it is a massive red flag for long-term sustainability. Where does that money come from? Usually, it’s just more $HYPER tokens being minted. If everyone tries to sell those rewards at once when the token finally hits major exchanges, the price usually craters faster than a lead balloon.

Why People Think It’s a Scam

When you search "is bitcoin hyper legit," you'll find plenty of skeptics. Their reasons usually fall into three buckets:

- The "Hyper" Name Trauma: The crypto world is still reeling from the collapse of the "Hyper" ecosystem (HyperVerse, HyperFund) led by Sam Lee. While there is no evidence that Bitcoin Hyper is linked to those old Ponzi schemes, the name alone makes people's skin crawl. It’s like naming a new cruise ship The Titanic II. Why would you do that?

- Lack of a Minimum Viable Product (MVP): As of mid-2025, a lot of the hype was based on a whitepaper and a roadmap. In crypto, "coming soon" is the most dangerous phrase in the English language.

- The Meme Angle: Using a Pepe-style mascot makes it look like a "degen" play. Real tech usually doesn't need a cartoon frog to sell it.

On the flip side, the project has undergone audits by firms like CertiK. That’s not a "get out of jail free" card, but it does mean the smart contract code—at least the part they showed the auditors—isn't a blatant rug pull waiting to happen.

The Technical Reality: Can It Actually Work?

Technically, yes. Building an L2 on Bitcoin using SVM is possible. Other projects like Mezo and Botanix are trying similar things. The real challenge is the "Canonical Bridge."

To use Bitcoin Hyper, you have to lock up your real Bitcoin on the main chain and get "wrapped" tokens on the L2. If that bridge gets hacked? Your Bitcoin is gone. 2024 and 2025 were full of bridge hacks that drained hundreds of millions of dollars. For Bitcoin Hyper to be truly legit, its bridge security needs to be ironclad.

A Quick Reality Check on the Numbers

Don't get blinded by those price predictions you see on Binance Square or Twitter. Some "analysts" are calling for a 7,000% gain by 2030.

Let's be real. If $HYPER hits those numbers, it would need a market cap larger than some small countries. It’s possible for a small investment to moon, but betting your rent money on a 15x return in a single year is a one-way ticket to a ramen-only diet.

Is Bitcoin Hyper Legit? The Verdict

Is it a blatant scam like a fake celebrity giveaway? Probably not. It has a real whitepaper, an audit, and a clear (if ambitious) technical goal.

Is it a safe investment? Absolutely not.

It’s a high-risk, high-reward "moonshot." If the team actually delivers the mainnet and people start building dApps on it, $HYPER could become a major player in the "Bitcoin DeFi" (BTCFi) narrative. If they vanish or the bridge gets exploited, it’ll just be another footnote in a YouTube documentary about crypto failures.

Actionable Next Steps for You

If you’re still thinking about jumping in, do these three things first:

- Check the GitHub: Look for "Bitcoin Hyper" or its developers. If there’s no code being updated, the project is a ghost.

- Verify the Audit: Don't just take their word for it. Go to the auditor's official website (like CertiK) and search for the project name to see the actual report.

- Use a Burner Wallet: If you participate in any "staking" or "claims," never use your main wallet that holds your life savings. Use a fresh wallet with only the amount you’re willing to lose.

The Bitcoin L2 space is the new frontier. It’s wild, it’s messy, and it’s full of both geniuses and thieves. Stay skeptical.