Everyone is waiting for the floor to fall out.

You see it in the comments sections and hear it at backyard barbecues. People are convinced that because prices are high and everything feels "bubbly," we’re about to see a 2008-style fire sale where suburban three-bedroom homes go for the price of a used Honda Civic.

But honestly? The math just doesn’t back up the doom-scrolling.

While "crash" is the word that gets the clicks, what we’re actually seeing as we move through early 2026 is something much weirder and, frankly, a bit more boring. It’s a slow-motion rebalancing. Some call it the "Great Housing Reset."

If you’re sitting on the sidelines waiting for a total collapse before you buy, you might be waiting a very long time. Here is the reality of what’s happening with the question: is the housing market about to crash?

The 2008 Ghost vs. the 2026 Reality

Most people asking if a crash is coming are still traumatized by the Great Recession. Back then, you could get a mortgage if you had a pulse and a dream.

Today is different.

Lending standards are remarkably strict. We aren't seeing the "ninja loans" (No Income, No Job, No Assets) that fueled the last disaster. According to recent data from Freddie Mac and the New York Fed, the average credit score for new mortgage originations remains near historic highs. Most homeowners aren't just barely hanging on; they are sitting on mountain-high piles of equity.

Even with the economy feeling a bit shaky and "economic anxiety" being a real headwind—as Bright MLS Chief Economist Lisa Sturtevant recently pointed out—most people aren't forced to sell. If you have a 3% mortgage rate from 2021 and $200,000 in equity, you don't "panic sell" just because the market cools. You just stay put.

👉 See also: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

That "stay put" mentality is exactly why inventory, while rising, is still about 12% below pre-2020 averages.

You can't have a price crash without a massive flood of desperate sellers. Right now, there’s no flood. Just a leaky faucet of new listings.

Why 2026 Feels Different (And Where the "Mini-Crashes" Are)

National averages are a lie.

If you look at the broad U.S. market, prices are actually expected to rise slightly this year—maybe 1% to 2% according to Zillow and Realtor.com. That isn't a crash. It’s a plateau.

But if you zoom in, some places are seeing corrections.

- Austin and San Antonio: These pandemic darlings are cooling off fast.

- Coastal Florida: Surging insurance costs and natural disaster risks are forcing some "must-sell" situations.

- The Sunbelt: Cities that saw 50% growth in two years are finally giving back some of those gains.

In these spots, you might see 5% or 10% dips. But a "crash" usually implies a 20%+ drop across the board. We just aren't seeing the supply levels necessary to trigger that kind of freefall.

The "Lock-in" Effect is Real

Think about your friend who bought a house four years ago. Their monthly payment is probably $1,800. If they moved today to a similar house, even with rates dipping to the low 6% range like we saw this January, their payment would jump to $3,200.

Basically, people are "locked in" by their own good deals. This creates a floor for prices. Sellers won't sell unless they absolutely have to, which keeps supply low enough that even weak demand can't push prices off a cliff.

✨ Don't miss: Is Today a Holiday for the Stock Market? What You Need to Know Before the Opening Bell

Mortgage Rates: The 6% Psychological Barrier

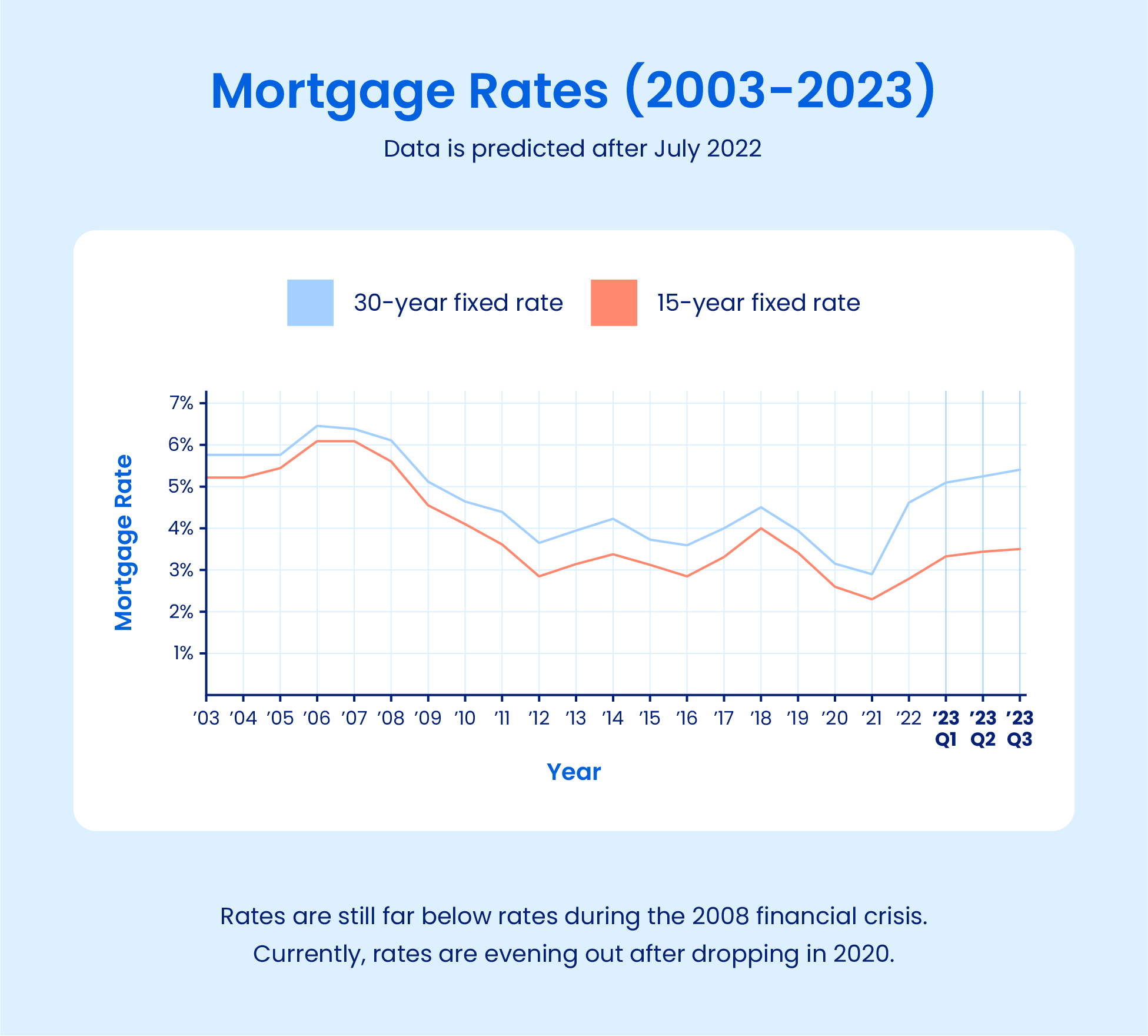

We just saw the 30-year fixed-rate mortgage average hit 6.06% in mid-January 2026.

That’s a big deal.

For the last two years, the market has been suffocating under 7% rates. Dropping toward 6% (or even high 5%s in some cases) is like opening a window in a stuffy room.

Lawrence Yun, the Chief Economist at the National Association of Realtors (NAR), is actually predicting a 14% increase in existing-home sales for 2026. He isn't looking for a crash; he’s looking for a rebound. When rates drop even a little, the "sideline sitters" jump back in. This pent-up demand acts as a safety net. Every time prices start to dip, a group of buyers who were previously priced out suddenly finds the math works again and they buy the dip.

The DOGE Factor and Government Policy

We have to talk about the wildcard: policy.

With the Department of Government Efficiency (DOGE) initiatives starting to ripple through the federal workforce, we’re seeing localized impacts. Take Washington, D.C., for example. Cotality recently noted that D.C. has become one of the fastest-depreciating markets. Why? Because if you’re a federal worker and you’re worried about your job, you aren't exactly rushing to sign a 30-year mortgage.

Then there’s the "Trump bond-buying" talk.

There was a recent move to try and push mortgage rates down through executive-level pressure on bond markets. It caused a temporary dip, but as Sean Salter from Middle Tennessee State University noted, without the Fed's full cooperation, these "artificial" dips might not last.

🔗 Read more: Olin Corporation Stock Price: What Most People Get Wrong

The takeaway? The government is trying to make housing more affordable, not crash the market. A crash destroys the banking system and erases the middle class's primary wealth. No one in power wants that.

Is the Housing Market About to Crash? The Verdict.

If you are waiting for a 2008 replay to finally buy a house, you’re likely going to be disappointed.

The "bubble" isn't popping; it’s leaking air.

We are entering a "buyer’s market" in terms of leverage—you can finally ask for repairs or a price credit—but we aren't in a "buyer's market" in terms of prices. You’re still going to pay a lot. You’re just not going to have to fight twenty other people and waive your inspection to do it.

Actionable Next Steps for 2026

- Stop looking at national headlines. Your local market is the only one that matters. If you’re in Phoenix, you have more leverage than if you’re in Newark or Chicago right now.

- Watch the "Real" Price. Inflation is still hovering around 3%. If home prices only go up 1%, your home actually lost "real" value. This is great for buyers because it means houses are becoming cheaper relative to your paycheck, even if the "sticker price" doesn't change much.

- Check your "BuyAbility." With rates in the low 6s, your monthly payment is roughly $150–$200 lower than it was a year ago on a typical $400,000 home. Run the numbers again; you might be surprised.

- Target "Stale" Listings. Look for houses that have been on the market for 60+ days. In this "Reset" market, those sellers are often willing to buy down your interest rate just to get the deal done.

- Don't time the bottom. If you find a house you love and can afford the payment, buy it. Waiting for a "crash" that doesn't come could cost you more in rent and lost equity than a 2% price dip ever would.

The market is firming up, not falling apart. It's a boring, slow, and frustrating transition back to "normal," but "normal" is a whole lot better than a crash.

Source References:

- NAR Existing-Home Sales Report, January 14, 2026

- Freddie Mac Primary Mortgage Market Survey, January 15, 2026

- Realtor.com 2026 National Housing Forecast

- Redfin: The Great Housing Reset 2026

- Zillow Real Estate Market Report, January 2026

Expert Insight: 2026 is the year of the "Small Win." We aren't seeing massive wealth creation from home appreciation anymore, but we also aren't seeing the systemic collapse many feared. It's a market defined by cautious progress and regional divergence. Buyers have more choices, but sellers still have the equity.