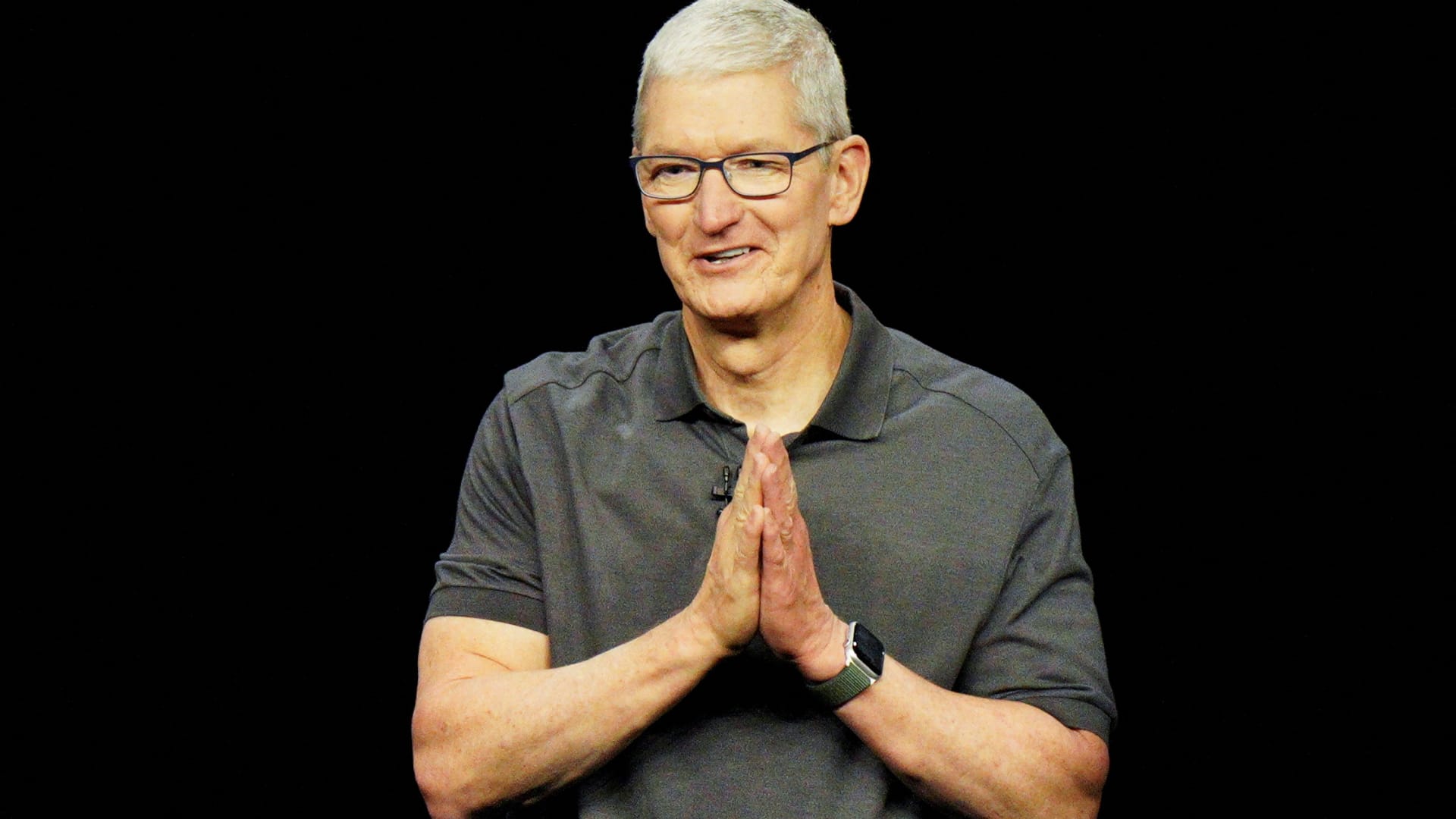

People still compare Tim Cook to Steve Jobs. It’s the ultimate tech industry cliché. But honestly, if you're still looking for a "visionary" who wears black turtlenecks and yells at engineers, you’re missing the entire point of what happened to Apple over the last fifteen years.

Cook didn't just keep the lights on. He rebuilt the house from the foundation up while everyone was watching the windows.

As we sit here in 2026, Apple is a different beast. It’s a multi-trillion-dollar machine that moves with a level of precision that would have been impossible in the 90s. When Tim Cook took over in 2011, Apple’s market cap was under $400 billion. Today? We’re looking at a company that has danced with the $4 trillion mark. That’s not a fluke. It’s the result of a very specific, very quiet type of genius.

The Logistics of a Legacy

Most people think of Apple as a design company. They’re wrong. Under Tim Cook with Apple, it became a logistics company that happens to sell beautiful products.

Before he was CEO, Cook was the "Operations Guy." He’s the one who looked at Apple’s inventory in 1998 and called it "fundamentally evil." He famously compared electronics to dairy products—if they sit on a shelf for more than a few days, they spoil. He slashed inventory turnover from months to just five days. Think about that. Every five days, the entire stock of Apple’s global empire refreshes.

Why the "Boring" Stuff Won

While the world wanted another "one more thing" moment, Cook was busy diversifying where your iPhone is actually made.

💡 You might also like: How to Connect Beats to Bluetooth Without Losing Your Mind

- The India Pivot: As of 2026, more than 25% of all iPhones are assembled in India. This wasn't just a political move; it was a survival tactic to escape the "China-only" trap.

- The M-Series Bet: Ditching Intel wasn't just about speed. It was about vertical integration. By making their own silicon, Cook's Apple saved an estimated $2.5 billion in the first year alone.

- Inventory as a Weapon: By pre-buying components years in advance, Apple effectively starves its competitors of the parts they need to launch rival phones.

It’s ruthless. It’s quiet. And it’s exactly why Apple survived a decade of "peak smartphone" and came out more profitable than ever.

Leading Differently: The Democratization of Apple

Steve Jobs was an autocrat. He micromanaged the curvature of the icons. Cook? He’s a "multiplier."

He doesn't pretend to be the lead designer. Instead, he empowers guys like Craig Federighi and (before his recent departure) Jeff Williams to run their divisions like mini-CEOs. This shift changed the culture. It’s less of a cult of personality now and more of a high-performance athletic team.

But don't mistake his "democratic" style for being soft.

Internal stories describe Cook’s management style as "death by a thousand questions." He will sit in a meeting and calmly ask the same question ten different ways until he finds the one person who didn't do their homework. He doesn't need to scream. He just needs to know if you know your numbers. If you don't, you're done.

The 2026 Reality: AI and the Vision Pro

We have to talk about the elephant in the room: Apple Intelligence.

For a while there, it looked like Apple missed the AI bus. While Microsoft and Google were shouting about LLMs, Apple was silent. Then came the 2025/2026 rollout. Typical Cook. He waited until the tech was "Apple-ready"—meaning private, on-device, and actually useful for normal people, not just coders.

The partnership with Google to use Gemini for cloud tasks (while keeping the sensitive stuff on your A19 chip) is a classic Cook move. It’s a bridge. It keeps the "Walled Garden" secure while giving users the power they demand.

Then there's the Vision Pro.

💡 You might also like: What Really Happened With General Motors Discontinues CarPlay Android Auto

The original $3,500 price tag was a tough pill for most to swallow. But looking at the roadmap for late 2026, the rumored "Vision Air" at a $2,000 price point shows the strategy. Apple doesn't need to win on day one. They just need to own the ecosystem by day one thousand.

What Most People Get Wrong

The biggest misconception? That Cook is just a "bean counter."

You don't push for 100% carbon neutrality by 2030 just to save money. You don't fight the FBI over encryption if you only care about margins. Cook has tied Apple’s brand to privacy and sustainability in a way that makes it nearly impossible for competitors to pivot. It’s a "values-based" moat.

He understood early on that in a world where everyone has a good screen in their pocket, the only thing left to sell is trust.

Real Talk on the Numbers

Apple's 2026 shareholder letter revealed executive compensation for Cook at around $74 million. To some, that’s obscene. To shareholders who saw their $1,000 investment in 2011 turn into roughly $2.6 million by 2025 (including dividends and splits), it’s a bargain.

Services revenue—the stuff like iCloud, Apple Music, and the App Store—is now a $100 billion-a-year business. That’s a Fortune 50 company living inside a hardware company.

Actionable Insights for the Future

If you’re watching Apple’s trajectory, here is what you actually need to pay attention to:

- Watch the "China + 1" Strategy: Apple is moving production to Vietnam and India faster than people realize. Any disruption in these regions now hits Apple harder than a trade war with China used to.

- The Silicon Lifecycle: The M5 and A19 chips aren't just incremental. They are designed specifically for "Edge AI." If your current device can't run local LLMs, it’s going to feel like a brick by 2027.

- The Services Pivot: Keep an eye on "Apple Intelligence+." A subscription tier for advanced AI features is almost certainly coming. This is how Apple moves from a hardware cycle to a recurring revenue model.

Tim Cook didn't try to be Steve Jobs. He tried to make Apple big enough to survive without him. Whether he steps down in 2026 or stays until 2029, he’s already won the long game. He turned a creative boutique into a global utility. You might miss the drama of the Jobs era, but you can't argue with the fortress Cook built.

To stay ahead of the next cycle, focus on the "Edge AI" transition. The hardware super-cycle is starting now as users realize their older iPhones simply can't handle the new Siri. If you're an investor or a power user, that's the metric that matters most: the gap between what the chip can do and what the cloud requires.